Potential Impacts of the 25% Tariff Levied by the EU and UK on U.S. Tobacco, Tobacco Products, & Sweet Potatoes

go.ncsu.edu/readext?755788

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲Blake Brown, Hugh C. Kiger Professor

November 23, 2020

On November 10, 2020, the European Union imposed retaliatory tariffs on imports of an array of U.S. goods including 25 percent tariffs on tobacco and sweet potatoes. The tariffs were part of an ongoing trade dispute between the U.S. and EU over alleged subsidies in the airline industry. In 2019 the U.S. levied additional tariffs on $7.5 billion of EU goods. This fall the WTO authorized the EU retaliatory tariffs on $4 billion of U.S. goods which includes sweet potatoes and tobacco. Left unresolved, the loss of exports of sweet potatoes and tobacco will have large adverse impacts on the agricultural sector and the rural economies it supports; particularly the North Carolina economy where most sweet potatoes and tobacco are produced. This analysis examines potential impacts using United Nations trade data and scenarios analyzed using IMPLAN1 (a model for estimating direct, indirect and induced effects of a change in an economy). The 25 percent tariff on U.S. tobacco and sweet potatoes increases prices to EU consumers placing U.S. producers at a significant price disadvantage.

- The 2019 farm gate values of production of sweet potatoes and tobacco in the U.S. were $588 million and $946 million, respectively.2 North Carolina accounted for 55 percent of the value of sweet potatoes and 47 percent of the value of tobacco production. In 2019 the value of EU (including the UK) imports of U.S. sweet potatoes was $70 million.3 The value of 2019 EU imports of U.S. tobacco and tobacco products was $274 million with unmanufactured tobacco making up $252 million of this total.3

- The response to the 25 percent tariff of EU manufacturers purchasing U.S. tobacco will depend in part on how long they think the tariff will remain in place. In the short run they may stop buying U.S. tobacco and try to pull down their inventories of tobacco either hoping that the trade dispute will be resolved quickly or waiting for supplies of reasonable substitutes for U.S. tobacco to become available. The 2020 southern hemisphere crops of tobacco from Brazil and Zimbabwe were smaller than previous crops and the Brazil crop was reportedly lower in quality. In the face of higher U.S. prices due to the tariff EU manufacturers might hope to fulfill their needs with the 2021 Brazil crop that will be marketed early next year.

- Trade diversion might mitigate some of the adverse effects of the tariff. Trade diversion could occur if, for example, EU customers turned to Zimbabwe and bid tobacco away from existing buyers in Zimbabwe. Those buyers then might make their purchases from the U.S. since they do not incur the tariff imposed by the EU. While this lessens the adverse effect, the U.S. would still have lower exports than if a tariff had not been imposed by the EU.

- Europe has been a growing market for U.S. sweet potato farmers who are largely responsible for the introduction of sweet potatoes to Europeans. European consumers will reduce their consumption of sweet potatoes in response to higher prices substituting other foods and perhaps sweet potatoes from other suppliers for U.S. sweet potatoes in their diets.

- European farmers and produce companies have been increasing the quantity and quality of sweet potatoes produced; primarily in Spain but also in northern Africa. A prolonged trade dispute and tariff on U.S. sweet potatoes provides the opportunity for European producers to gain market share at the expense of U.S. producers.

- Should the trade dispute be prolonged, while difficult to forecast precisely, a reasonable scenario is that the U.S. loses 75 percent of its export market to the EU for tobacco and all of its export market to the EU for sweet potatoes.4 This would mean a loss of tobacco exports of about $147 million in farm gate value and $58 million in processing and manufacturing value plus $70 million in sweet potato exports.

- Many U.S. farms that produce sweet potatoes also produce tobacco. The loss of over $147 million in annual tobacco exports and as much as $70 million in annual sweet potato exports would be a significant blow to these farms and the rural communities they support.

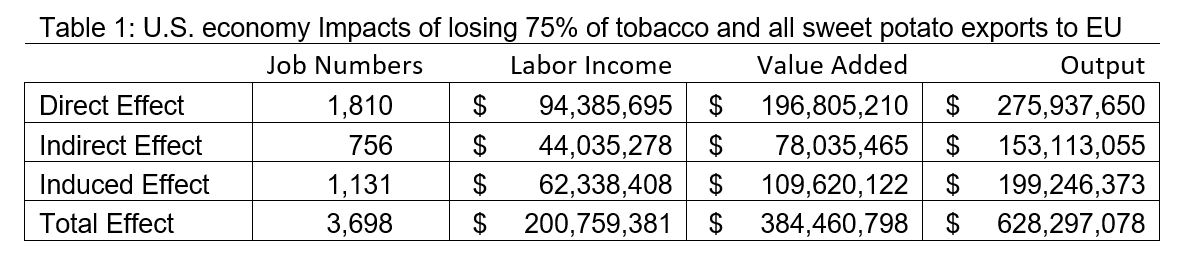

- Such a scenario would also have large, economy-wide impacts. Table 1 provides estimates of the direct, indirect, and induced impacts of the loss of 75 percent of U.S. tobacco exports to the EU and the loss of all sweet potato exports to the EU.

- Tobacco manufacturing and processing and tobacco farming plus sweet potato farming lose over 1,800 jobs, over $94 million in labor income, and $276 million in economic output.

- The indirect effects reflect the reduced sweet potato and tobacco growing and industry purchase of goods and services from other industries. They are estimated at 756 jobs and $153 million in output lost.

- The induced effects reflect the economy-wide losses due to changes in employee spending resulting from job losses. They are estimated at 1,131 additional job losses with a reduction in economic output of almost $200 million.

- Total impacts from this scenario are 3,698 jobs lost with resulting payroll loses of over $200 million and over $628 million in economic output lost.

- The impacts are particularly concentrated in North Carolina and its agricultural sector and rural economies since it produces 55 percent of U.S. sweet potatoes and 47 percent of U.S. tobacco.

____________________________________________________________________________________

1 Copyright 2020 Minnesota IMPLAN Group, Inc.

2USDA-NASS. Quickstats. Downloaded November 20, 2020.

3USDA-FAS. GATS United Nations Import Data. Downloaded November 21, 2020.

4This scenario assumes an intermediate to long-run elasticity of export demand for U.S. tobacco of -3. While this parameter is not well documented, this estimate is consistent with previous research. The demand by European consumers for U.S. sweet potatoes is likely very elastic given the availability of substitute foods in the diet and the increasing production of sweet potatoes by EU and UK producers.